IMPORTANT NOTICE TO ALL OUR CLIENTS AND STAKEHOLDERS.

SAMOA TAX REFORMS – EFFECTIVE JANUARY 2018!

Matters of Priorities

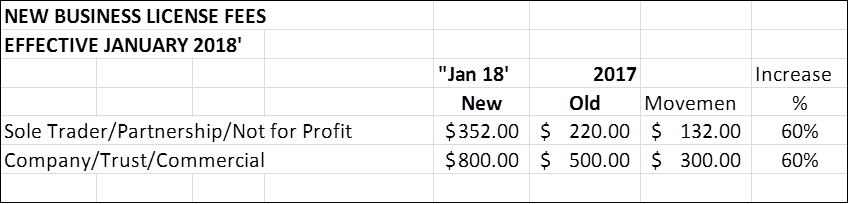

1. Massive increase by 60% on annual business license per annum

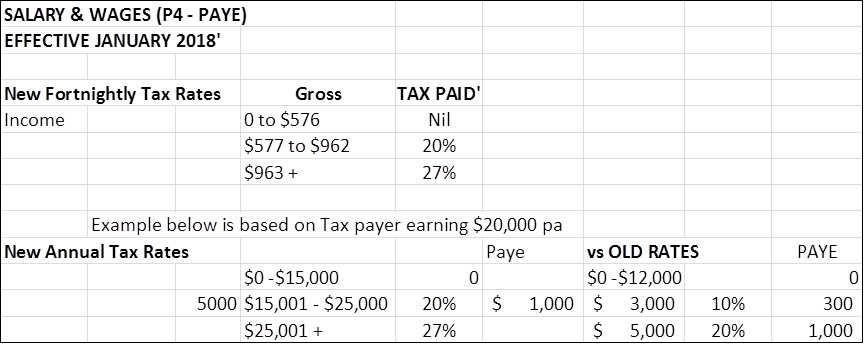

2. Apart from the increase in Business licenses, Sole traders will entertain the newly effective tax rates which saw the threshold increase from $12,000 to $15,000 per annum. Below example illustrates tax savings with new rates compared to prior years.

Promulgation – There will be no more weekly tax table and if your staff and employees are paid weekly, there will only be a fortnightly table available hence you need to combine the two pay periods and enter into the table when filing monthly P4s.

3. EXPORT TAX CREDIT (activity)

50% of the tax payable to be paid only by exporters of goods (re-export excluded) provided exporters remit back to Samoa 100% of profits

Eligibility Rules – (i) Any Resident Exporter for tax purposes with

- Valid exporter business license

- Register for VAGST

- Register for PAYE

(ii) Exporter of Goods only NOT exporter of Services

(iii) Prove 100% of profit is remmitted back to Samoa

Export Tax Credit (ETC) Application;

- A)For income tax purposes only

- B)Applies on “Tax Payable” only (Net Profit)

- C)50% allowed as Tax Credit on Tax liability

- D)If LOSS, ETC cannot be carried forward.

4. TAX CREDIT SCHEME THROUGH APPROVED TOURISM DEVELOPMENT

MfR Advises that paper is with Revenue Board to extend timing form June 2017 to end of December 2017 or June 2018.

Recommendations was proposed by members if there is a possibility to defer effective date of changes due to unreasonable timing which is less than two weeks before month end but no luck.

Tagaloa Faafouina Su'a

Partner

View Images Below:

.jpg)