Anti-Money Laundering and Countering Financing of Terrorism Audits

Clive McKegg

August 28, 2018 15:49

History:

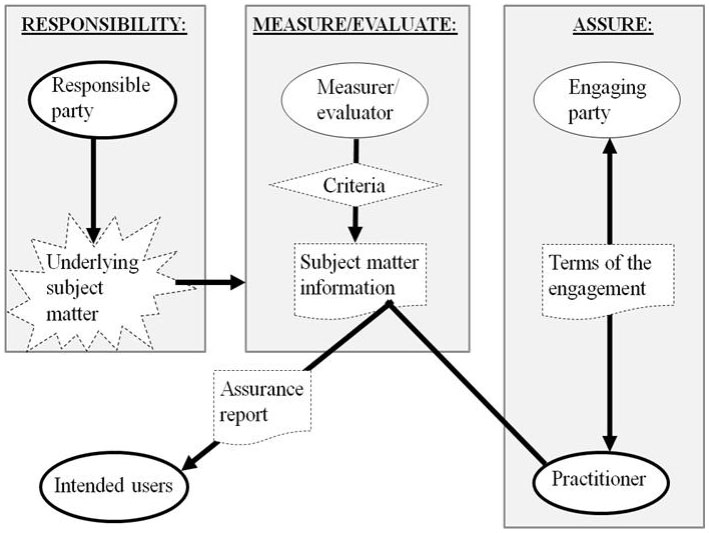

- AML/CFT Audit (Beta Released 30 May 2018) - For use in the audit of compliance with requirements of Anti-Money Laundering and Countering Financing of Terrorism Act 2009. Based on SAE 3100 (Revised), ISAE (NZ) 3000 (Revised) and SAE 3150.

Updated to:

- AML/CFT Limited Assurance Compliance Engagement (Full release 10 July 2018) - For use in carrying out limited assurance compliance engagement in accordance with requirements of Anti-Money Laundering and Countering Financing of Terrorism Act 2009. Based on SAE 3100 (Revised), ISAE (NZ) 3000 (Revised) and SAE 3150. Includes assurance reports as recommended by CAANZ.

Effective from 1 January 2018 so…In use 30 June 2018 & 31 December 2018

BUT REMEMBER…..Comparatives will include 2017.

IFRS 15 replaces;IT

- IAS 18 Revenue,

- IAS 11 Construction Contracts

- SIC 31 Revenue – Barter Transaction Involving Advertising Services

- IFRIC 13 Customer Loyalty Programs

- IFRIC 15 Agreements for the Construction of Real Estate and

- IFRIC 18 Transfer of Assets from Custome

THE NEW AUDIT REPORT – A STEP CHANGE

CHANGES at a glance

- KEY AUDIT MATTERS (KAM) – why the auditor judge a matter

- How that matter was addressed in the audit and

- Reference to any related financial disclosures

- Letting the readers know how auditors arrived at conclusion rather than just a “Fairly Stated”

- Name the Engagement Partner – SU’A ma PAUGA already adopted this 4 years ago

it is the auditor’s story about the audit, not the auditor’s story about the entity

The IAASB finalized its new international standards in 2014 and these come into effect, basically, for 2016 audits. But not many are waiting. It is fascinating that we see more and more "early birds" – applying Key Audit Matters (KAM) and voluntarily adopting the new reporting. In Poland, the law still has to come – but some auditors could not wait. And similarly ‘early birds’ applying KAM in Germany, in Switzerland. For the rest of Europe, enhanced auditor’s reports will be required for Public Interest Entities starting for June 2017 year ends.

What is OCI?

IAS 1 defines a complete set of financial statementsas comprising statements of financial position, comprehensive income (often referred to as P&L or the income statement), cash flows and changes in equity, plus the related explanatory notes. IAS 1 requires all income and expense items to be presented in the statement of comprehensive income.

These items are presented in the profit or loss section of the statement unless an IFRS requires it to be presented in a separate section called other comprehensive income (OCI).

Examples of items that IFRSs require or permit to be presented in OCI are:

- Foreign currency translation adjustments on foreign subsidiaries

- Actuarial gains and losses arising on defined benefit plans

- Revaluations of property, plant and equipment

- Changes in fair value of financial instruments in a cashflow hedge.

Enhanced comparability with US GAAP

US GAAP and IFRSs differ on the presentation of OCI items.

US GAAP does not require OCI items to be presented in the statement of comprehensive income but allows them to be incorporated in the statement of changes in equity or in the notes. This makes it difficult to

identify and understand the nature of those gains and losses. These different approaches also make it difficult for users to compare financial statements prepared in accordance with US GAAP and those prepared in accordance with IFRSs.

The FASB has amended US GAAP to require profit or loss and other comprehensive income to be presented in either one statement or two continuous statements, with items of profit or loss presented separately.

The changes to IAS 1 and US GAAP will make it easier for users to compare the financial statements prepared in accordance with US GAAP with those prepared in accordance with IFRSs.

Interesting read on Forensic Accounting Services - View PDF file - (Click here)

Source: ICAANZ

Somewhere in the backblocks of Poland, Hungary or the Ukraine, a shadowy cyber-criminal gang is targeting vulnerable networks in Australia and New Zealand.

As governments grapple with an increasing number of cyber attacks, the manager of Cyber Crime Operations at the Australian Federal Police (AFP), Commander David McLean, candidly admits that most malicious attacks originate in Eastern Europe.

ISSUE 27

Office life

01 November 2016 - Leigh Sujanto

Real solutions to real problems

Q: What are some tips for baby boomers to give them an extra edge in today’s job market?

A: A baby boomer’s CV may demonstrate a solid history of successful outcomes and experience, but those alone might not stand out in today’s job market. To remain competitive you need to step outside your comfort zone, show you are continually up-skilling yourself, demonstrate digital know-how and be adaptable. These are qualities that organisations look for in order to not only adjust to new trends, but lead the way.

While the world has been busy adopting IFRS Standards, we at the IASB have been working hard to deliver substantial improvements to the quality of the Standards. In doing so, we have worked in close cooperation with the worldwide standard-setting community, such as the DRSC here in Germany. The best ideas from around the world have become the global standard.

Page 1 of 3