WHAT IS THE ISSUE HERE?

When a casual reader reads an audit report they expect to see a phrase that says something like “true and fair” or the more recent “fairly presented”. These are the words that indicate a “clean” report – so no need to read all the other boring detail!

The problem is – what about if those words are missing? What if the report just says “In our opinion, the accompanying financial statements of Client X Limited for the year ended xxxxx are prepared, in all material respects in accordance with the accounting policies stated in Note X,” [or whatever might be appropriate] And that’s it? Nothing about true and fair or fairly presented?

The wording above is what we are required to use in terms of ISA (NZ) 800 (revised) Audits of Financial Statements Prepared in Accordance with Special Purpose Frameworks if we are auditing certain kinds of financial statements. For example Illustration 2 from that standard: This really applies to the audit of special purpose report which are no General Purpose Financial Reporting (GPFRS).

APPLICATION TO SAMOA.

Very applicable to the audit of Projects which requires a hybrid approach ie partial agreed upon procedures and usual audit reporting requirements. With the introduction of the $1m Constituency Funding from Samoa Government to all the Constituents in Samoa. Obviously, 0n the face of the “”District Council Establishment Fund Guidelines”, auditors at a glance will assume the engagement as an Agreed Upon Procedures (AUP).

Remember CAATs? This was an acronym for Computer Assisted Audit Tools – a general category for all things computery that helped us work with more efficiency and power.

Now that virtually all we do uses a computer, ISA 315 (Revised 2019) does not refer to CAATs but to Automated Tools and Techniques (ATTs).

This kind of thing gets audit software developers like us salivating like Fluffy when the fridge door opens. But let’s stay calm and examine what the standard says first.

In support of the Government's mandate in assisting the development of small sized businesses, Cabinet has approved that the Tax Invoice Monitoring System (TIMS) will not apply to businesses with an annual turnover of less than SAT$200,000 tala.

Amendment to IFRS 16 Leases Paragraph 46B is amended. Paragraphs C1C and C20BA–C20BC are added. New text is underlined and deleted text is struck through.

Lessee ...

Measurement ...

Subsequent measurement ...

Lease modifications ...

The practical expedient in paragraph 46A applies only to rent concessions occurring as a direct consequence of the covid-19 pandemic and only if all of the following conditions are met:

Auditors are prime candidates for burnout, but some accounting firms are dealing with mental health head on.

IN BRIEF

- Auditors are at risk of burnout due to the constant nature of the job.

- COVID-19 has shone the spotlight on mental health across the accounting profession.

- Restructuring workflow may help mid-tier firms reduce the burnout risk.

SHOULD SAMOA ADOPTS THE USA COVID RELIEF GRANTS FOR BUSINESSES AND PEOPLE WITH SEVERE IMPACT. ALTHOUGH FACING THE CRISIS, THE NPF 10% INCREASE CONTINUES!

SBA debt relief

SBA offers debt relief to existing SBA loan borrowers whose businesses have been impacted by COVID-19.

Paycheck Protection Program

An SBA-backed loan that helps businesses keep their workforce employed during the COVID-19 crisis.

COVID-19 Economic Injury Disaster Loan

This loan provides economic relief to small businesses and nonprofit organizations that are currently experiencing a temporary loss of revenue.

IMPORTANT NOTICE TO ALL OUR CLIENTS AND STAKEHOLDERS.

SAMOA TAX REFORMS – EFFECTIVE JANUARY 2018!

Matters of Priorities

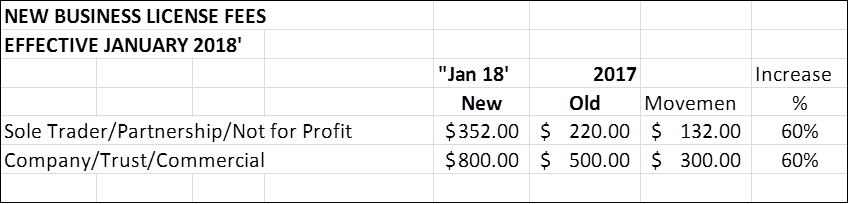

1. Massive increase by 60% on annual business license per annum

Ministry of Finance in partnership with Samoa Chamber of Commerce Wage Subsidy Scheme Fact Sheet Overview:

Wage subsidy will be available for Employees in the affected Tourism and Hospitality/Manufacturing Industries who are struggling to retain employees because of Covid 19.

The Wage subsidy is to be distributed via the Employers to affected employees. Amount of support: Universal wage subsidy to all affected Employees from the Tourism and Manufacturing sector affected by Covid 19.

A paid out flat rate approved and decided by the Ministry of Finance. Read More PDF File

CARES Act for all Amercans – Isn’t is Brilliant!

To provide emergency assistance and health care response for individuals, families, and businesses affected by the 2020 coronavirus pandemic.

Coronavirus Aid Relief & Economic Security Act (CARES) provides for all and considered it a fair distribution to all Americans that contributes to the FICA and development of America. Couples earning less than $75,000USD are entitled to $1,200USD per month for the next 6 months.. Inter alia other benefits such as loan forgiveness for payroll bridging funds etc.

I applaud the foresight by Trump and his administration and thank you for the EIP payment.

Background

The COVID-19 pandemic and the government interventions to mitigate its effects have both immediate and on-going financial impacts. The nature and scale of these interventions vary

widely across jurisdictions, as will their longer-term impacts. However, the significant fiscal interventions launched by many governments mean that high-quality accrual-based financial

reporting is needed now, more than ever, as it provides better information for decision-making, improves transparency on how public resources are used, allows citizens to hold decision