by David Edgerton APV

Introduction

With the recent publication of IPSASBs new standards on Infrastructure and Measurement, it is appropriate to summarise the key changes from the old IPSAS17 Property Plant and Equipment and reflect on how the new IPSAS requirements differ from the existing IFRS valuation requirements. While there is a conceptual difference with IPSAS being an ‘entity specific entry price’ and IFRS being an ‘exit price at highest and best use’, in reality, almost of all of the requirements once the replacement cost of market value is determined are the same. This includes disclosures and the calculation of depreciation expense. read more Full PDF article >>

By David Edgerton APV

Historical Inconsistencies

Since the implementation of accrual accounting in the public sector there has been significant inconsistencies regarding the interpretation and association application of a range of valuation related aspects of the IFRS and IPSAS standards.

For example, in Australia, over the past 20 years the level of inconsistency has been exacerbated as a number of jurisdictions mandating the revaluation model for the first time and issuing guidance which was not consistent with practices adopted in other jurisdictions or jurisdictions had not updated their guidance despite significant changes in the accounting standards. read more Full PDF Article>>

Pacific Island Countries

Depending on whether and entity is a government department or agency or government owned enterprise, some pacific island countries adopt the IFRS standards (as done in Australia across all sectors) while others follow the IPSAS standards. read more Full PDF Article>>

WHAT IS THE ISSUE HERE?

When a casual reader reads an audit report they expect to see a phrase that says something like “true and fair” or the more recent “fairly presented”. These are the words that indicate a “clean” report – so no need to read all the other boring detail!

The problem is – what about if those words are missing? What if the report just says “In our opinion, the accompanying financial statements of Client X Limited for the year ended xxxxx are prepared, in all material respects in accordance with the accounting policies stated in Note X,” [or whatever might be appropriate] And that’s it? Nothing about true and fair or fairly presented?

The wording above is what we are required to use in terms of ISA (NZ) 800 (revised) Audits of Financial Statements Prepared in Accordance with Special Purpose Frameworks if we are auditing certain kinds of financial statements. For example Illustration 2 from that standard: This really applies to the audit of special purpose report which are no General Purpose Financial Reporting (GPFRS).

APPLICATION TO SAMOA.

Very applicable to the audit of Projects which requires a hybrid approach ie partial agreed upon procedures and usual audit reporting requirements. With the introduction of the $1m Constituency Funding from Samoa Government to all the Constituents in Samoa. Obviously, 0n the face of the “”District Council Establishment Fund Guidelines”, auditors at a glance will assume the engagement as an Agreed Upon Procedures (AUP).

Remember CAATs? This was an acronym for Computer Assisted Audit Tools – a general category for all things computery that helped us work with more efficiency and power.

Now that virtually all we do uses a computer, ISA 315 (Revised 2019) does not refer to CAATs but to Automated Tools and Techniques (ATTs).

This kind of thing gets audit software developers like us salivating like Fluffy when the fridge door opens. But let’s stay calm and examine what the standard says first.

In support of the Government's mandate in assisting the development of small sized businesses, Cabinet has approved that the Tax Invoice Monitoring System (TIMS) will not apply to businesses with an annual turnover of less than SAT$200,000 tala.

Amendment to IFRS 16 Leases Paragraph 46B is amended. Paragraphs C1C and C20BA–C20BC are added. New text is underlined and deleted text is struck through.

Lessee ...

Measurement ...

Subsequent measurement ...

Lease modifications ...

The practical expedient in paragraph 46A applies only to rent concessions occurring as a direct consequence of the covid-19 pandemic and only if all of the following conditions are met:

Auditors are prime candidates for burnout, but some accounting firms are dealing with mental health head on.

IN BRIEF

- Auditors are at risk of burnout due to the constant nature of the job.

- COVID-19 has shone the spotlight on mental health across the accounting profession.

- Restructuring workflow may help mid-tier firms reduce the burnout risk.

SHOULD SAMOA ADOPTS THE USA COVID RELIEF GRANTS FOR BUSINESSES AND PEOPLE WITH SEVERE IMPACT. ALTHOUGH FACING THE CRISIS, THE NPF 10% INCREASE CONTINUES!

SBA debt relief

SBA offers debt relief to existing SBA loan borrowers whose businesses have been impacted by COVID-19.

Paycheck Protection Program

An SBA-backed loan that helps businesses keep their workforce employed during the COVID-19 crisis.

COVID-19 Economic Injury Disaster Loan

This loan provides economic relief to small businesses and nonprofit organizations that are currently experiencing a temporary loss of revenue.

IMPORTANT NOTICE TO ALL OUR CLIENTS AND STAKEHOLDERS.

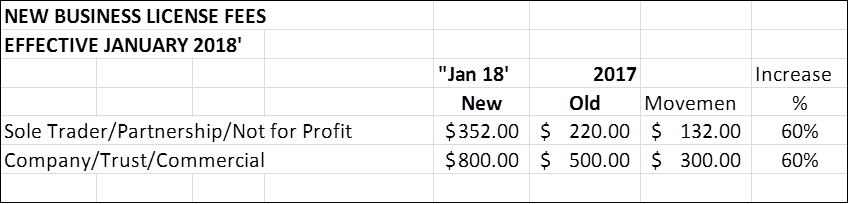

SAMOA TAX REFORMS – EFFECTIVE JANUARY 2018!

Matters of Priorities

1. Massive increase by 60% on annual business license per annum

Ministry of Finance in partnership with Samoa Chamber of Commerce Wage Subsidy Scheme Fact Sheet Overview:

Wage subsidy will be available for Employees in the affected Tourism and Hospitality/Manufacturing Industries who are struggling to retain employees because of Covid 19.

The Wage subsidy is to be distributed via the Employers to affected employees. Amount of support: Universal wage subsidy to all affected Employees from the Tourism and Manufacturing sector affected by Covid 19.

A paid out flat rate approved and decided by the Ministry of Finance. Read More PDF File

Page 3 of 5

.jpg)